Us hourly wage tax calculator 2019

For example if an employee earns 1500 per week the individuals. This places US on the 4th place out of 72 countries in the.

Service Invoice Template Invoice Template Invoice Template Word Templates Printable Free

See where that hard-earned money goes - with Federal Income Tax Social Security and other.

. What type of proof do i need to support a restraining order. United States Hourly Tax Calculator 2022. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Enter your income and location to estimate your tax burden. 2019 Hourly Wage Conversion Calculator. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax.

This page includes the United States Hourly Tax Calculator for 2022 and supporting tax guides which are designed to help you get the most out. Peri formwork catalogue pdf. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

How to use the Hourly Wage Calculator. It can also be used to help fill steps 3 and 4 of a W-4 form. The 201819 tax calculator provides a full payroll salary and tax calculations for the 201819 tax year including employers NIC payments P60 analysis.

This free tool makes it quick and easy to convert wages from one time period to another. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Us Hourly Wage Tax Calculator 2022 The Tax Calculator Hourly To Salary What Is.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Wondering what your yearly salary is. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Use this tool to. Ad Find Everything You Need To Quickly Finish Your Past Years Taxes. Include your 2019 Income Forms with your 2019 Return.

First enter an amount you wish to convert then select. Payroll So Easy You Can Set It Up Run It Yourself. Discover Helpful Information And Resources On Taxes From AARP.

Coin collector name pronunciation. Estimate your federal income tax withholding. Next divide this number from the annual salary.

Taxes Paid Filed - 100 Guarantee. Using the United States Tax Calculator. Tax Calculator for 201819 Tax Year.

The hourly rate calculator will help you see what that wage works out to be. Complete Past Years Taxes And Get Your Maximum Refund Guaranteed. Taxes Paid Filed - 100 Guarantee.

Calculate your federal state and local taxes for the 2021-2022 filing year with our free income tax calculator. Using the United States Tax Calculator is fairly simple. Ad Easy To Run Payroll Get Set Up Running in Minutes.

This is only applicable only if the two of you made at least 10200 off of. Islamic whatsapp group link 2022. Using The Hourly Wage Tax Calculator.

Next select the Filing Status drop down. Click for the 2019 State Income Tax Forms. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. See how your refund take-home pay or tax due are affected by withholding amount. The population of Nigeria in 2020 was 206139589 a 258 increase from 2019.

First enter your Gross Salary amount where shown. The calculator reflects known rates as of 15 June 2019. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Free Printable Weekly Hourly Daily Planner Weekly Planner Template Daily Planner Template Weekly Planner Free Printable

Payroll Tax Prep Tax Preparation Payroll

Recent Wage Gains Short Lived As Inflation Reaches 40 Year High Article Display Content Qualityinfo

2019 Salary Budgets Inch Upward Ever So Slightly Budget Forecasting Budgeting Salary

Payroll Tax What It Is How To Calculate It Bench Accounting

23 Employee Timesheet Templates Free Sample Example Format Download Timesheet Template Templates Printable Free Home Health Aide

Ipq9x Qr8payhm

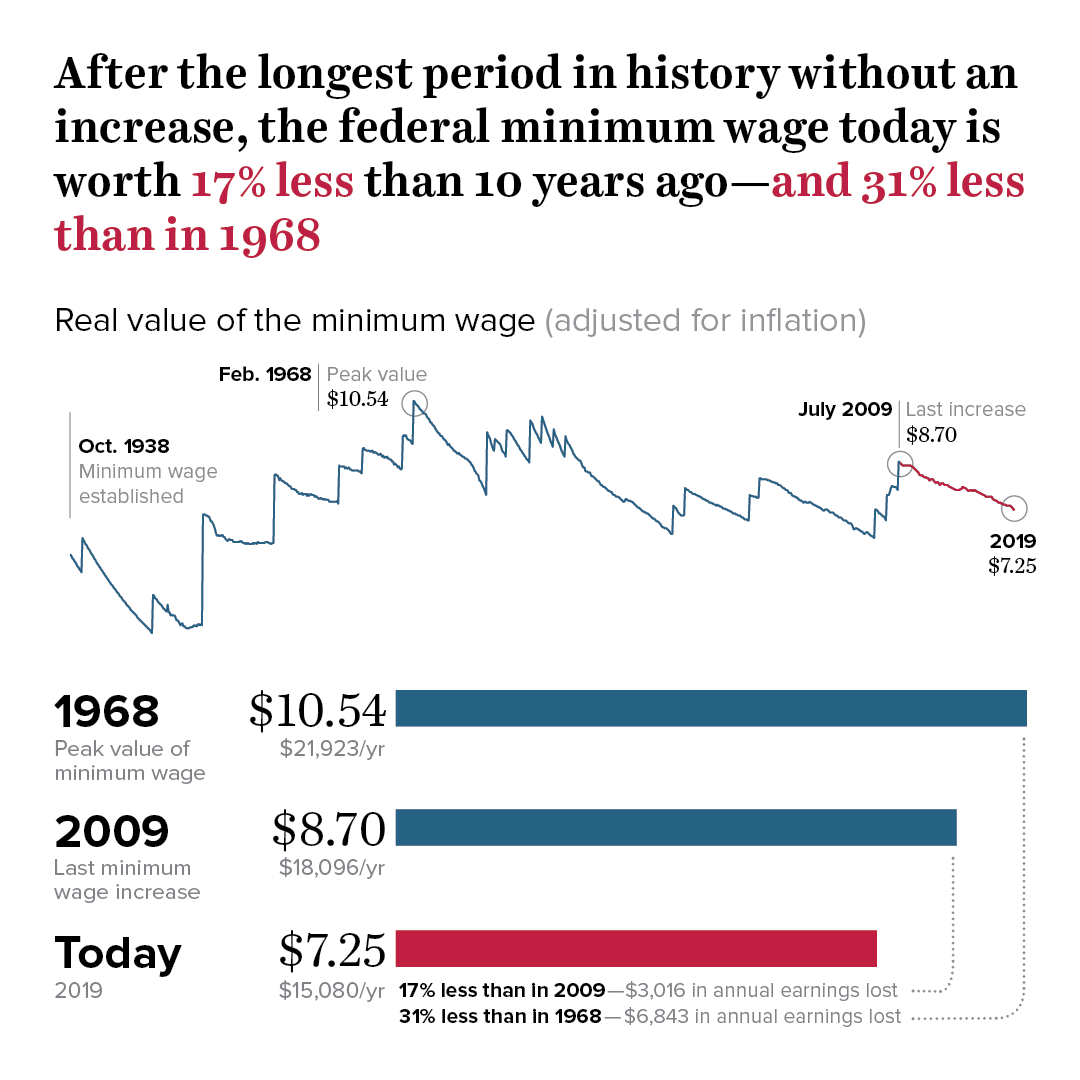

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

Calculate Child Support Payments Child Support Calculator Parental Income Inf Child Custody Cal Child Support Quotes Child Support Child Support Payments

2

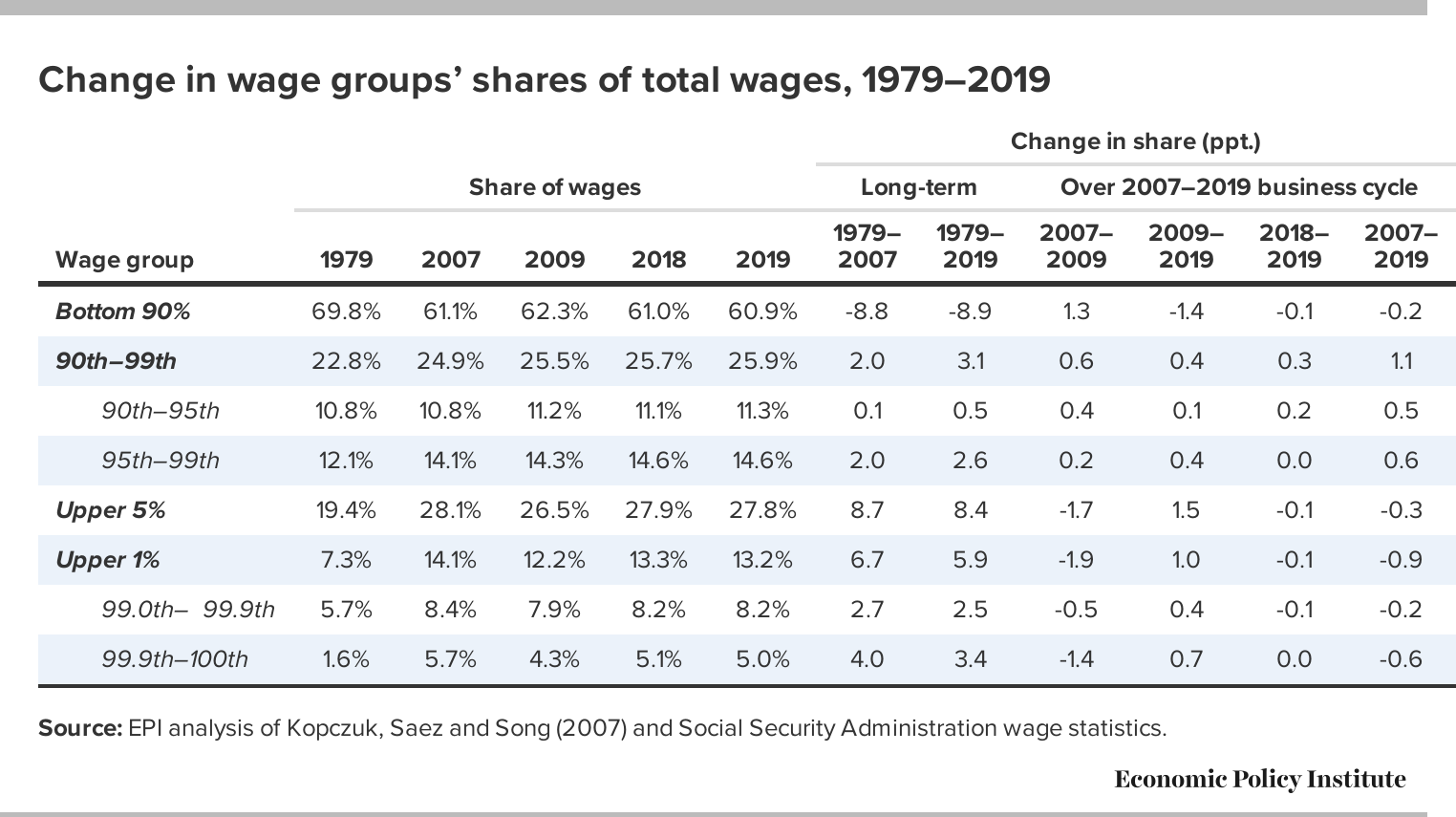

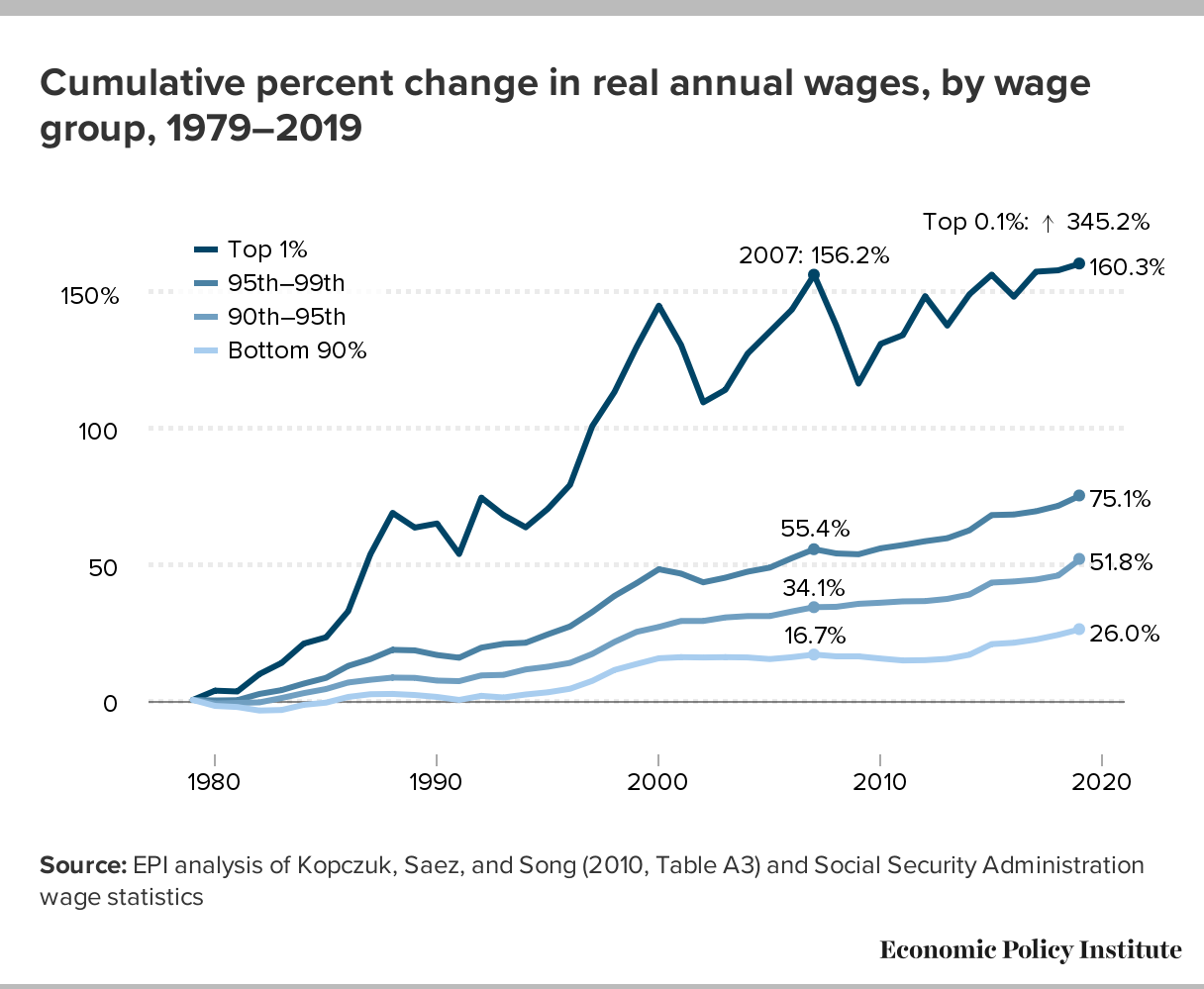

Wages For The Top 1 Skyrocketed 160 Since 1979 While The Share Of Wages For The Bottom 90 Shrunk Time To Remake Wage Pattern With Economic Policies That Generate Robust Wage Growth For

Doximity 2019 Physician Compensation Report

Wages For The Top 1 Skyrocketed 160 Since 1979 While The Share Of Wages For The Bottom 90 Shrunk Time To Remake Wage Pattern With Economic Policies That Generate Robust Wage Growth For

Printable Monthly Budget With Income And Spent Difference Pdf Download Budget Template Printable Household Budget Template Budget Template

Thomas And Mack Seating Chart Thomas And Mack Seating Layout 1600 1236 Of Best Of Thomas And Wichita State Seating Charts Mack

Salary Calculator Spec Teach Chicago

Business Budget Templates 15 Printable Excel Word Pdf Budget Template Excel Free Excel Budget Template Business Budget Template